(c) Copyright Resume Corner, Inc. DontSpendMore.com. All rights reserved.

New Study Uncovers Startling Facts About How Consumers Manage Credit Cards

DontSpendMore.com, New York -- A recent study by DontSpendMore.com revealed some very surprising insights about how consumers manage credit cards. Based on statistics provided by the Federal Reserve, the total outstanding revolving debt in US is estimated to be over $854 billion. The heavy debt load is indicative of the fact that an average American would be carrying thousands of dollars in unpaid debt.

“Despite serious repercussions on their credit and overall financial future, most respondents engaged in self-defeating behavior when it came to credit cards and overall credit management. The study revealed a disturbing trend indicating that over half of the respondents did not monitor their credit regularly. Further, nearly 90% of the respondents did not actively transfer their balances to lower interest rate credit cards,” says Nimish Thakkar, CEO of DontSpendMore.com, a site that helps consumers save hundreds of dollars every month.

Click here to compare and save on credit cards. Low APR and 0% APR credit card offers from multiple providers. Click here to save now. |

Here is a brief summary of the study’s findings:

Over 65% of the respondents did not monitor credit regularly

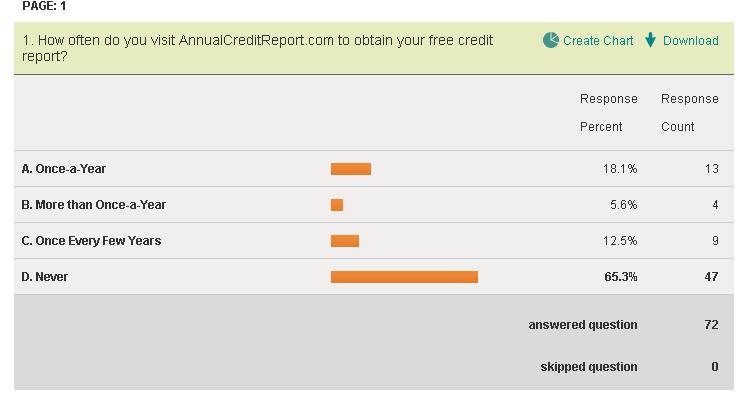

Although AnnualCreditReport.com is a free credit reporting service where consumers can obtain one free credit report every year, over 65% of respondents did not use the site to obtain their free annual credit report. Only 18% of the study participants used the site every year, while nearly 13% did so every few years. 89% were not enrolled in a paid credit monitoring plan.

Although AnnualCreditReport.com is a free credit reporting service where consumers can obtain one free credit report every year, over 65% of respondents did not use the site to obtain their free annual credit report. Only 18% of the study participants used the site every year, while nearly 13% did so every few years. 89% were not enrolled in a paid credit monitoring plan.

At DontSpendMore.com, you can compare and apply for low APR and 0% APR credit cards. These offers are ideal in terms of bringing down your interest expenses and also a viable platform to become debt free.

Nearly 56% of the respondents did not track bonuses and rewards points

Lured by travel rewards, percentage bonuses, and other rewards many individuals apply for credit cards in the hopes of gaining discounts and perks. Yet, nearly 56% of the respondents left the tracking and monitoring to credit card companies. This could be a cause of concern if there are important dates, redemption deadlines, and expiration policies associated with the account.

Lured by travel rewards, percentage bonuses, and other rewards many individuals apply for credit cards in the hopes of gaining discounts and perks. Yet, nearly 56% of the respondents left the tracking and monitoring to credit card companies. This could be a cause of concern if there are important dates, redemption deadlines, and expiration policies associated with the account.

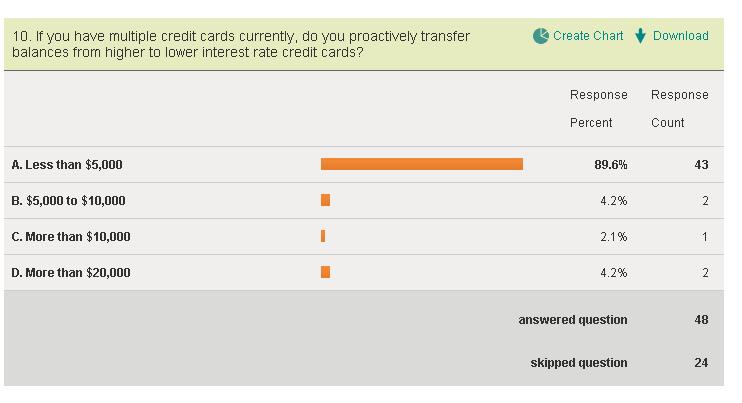

90% did not utilize the opportunity to cut credit card interest rates

Over 90% of the respondents said they either did not transfer at all or transferred less than $5,000 of outstanding balances to lower interest rate credit cards. This represents a lost opportunity to lower interest rates and monthly credit card expenses.

Nil response when it came to actively negotiating credit card rates

“It used to be much easier to negotiate credit card rates until recently, and although these days it is very hard to obtain a reduction many companies will work with you if your situation is unique,” says Thakkar. DontSpendMore.com’s research did not find any respondent who had actively worked with a credit card company to lower interest rates.

Not all findings were discouraging, though. Some positive findings include:

Improving trend in paying credit card bills

43% said they pay their bills in full every month. Only 9% make minimum payments while over 69% pay either in full or as much as possible.

Reduction in spending

Also, total 2012 annual credit card spending per individual was less than $5,000 for over 61% of the respondents.

Borrowers are diligent when it comes to reading credit card statements

36% spent between two and ten minutes to analyze their monthly credit card statements and 62% verified the accuracy of the numbers.

Study methodology

DontSpendMore.com commissioned SurveyMonkey.com to gather and analyze responses to ascertain credit card behavior. The respondents were randomly surveyed and included a demographic representative of the general US population. The following characteristics:

Gender: Male (49%) and Female (51%)

Age: 18 to 29 (40%), 30-44 (15%), 45-60 (22%), 60+ (23%)

Education: Some College (41%), College Degree (26%), Graduate Degree (23%)

Geographic Location: United States (Nationwide) For a detailed geographic distribution, you can download the survey summary at http://www.dontspendmore.com/survey_monkey_response.pdf

Over 72 respondents completed the questionnaire (ten questions total). Average survey completion time was 1 minute 13 seconds. Survey response rate was 22.4%.

DontSpendMore.com is a free site that helps consumers save hundreds of dollars every month on credit cards, cell phone plans, insurance, loans, mortgages, long distance, and more.

Media Contact: Nimish Thakkar, CEO

DontSpendMore.com

nimish@dontspendmore.com

You might need a loan at some point. At least now you know the easiest -- and cheapest -- way to go about getting one.

| Thank you for visiting us. Do consider visiting DontSpendMore.com to compare and save on credit cards, cell phones, loans, long distance, mortgages, Internet access, and more. |

Click here to find out how to save money on credit cards

Compare and save on credit cards, cell phone, long distance, Internet access, mortgages, insurance, and more at www.dontspendmore.com

Home Contact Us Partners Tell A Friend Privacy Policy About Us Terms of Service